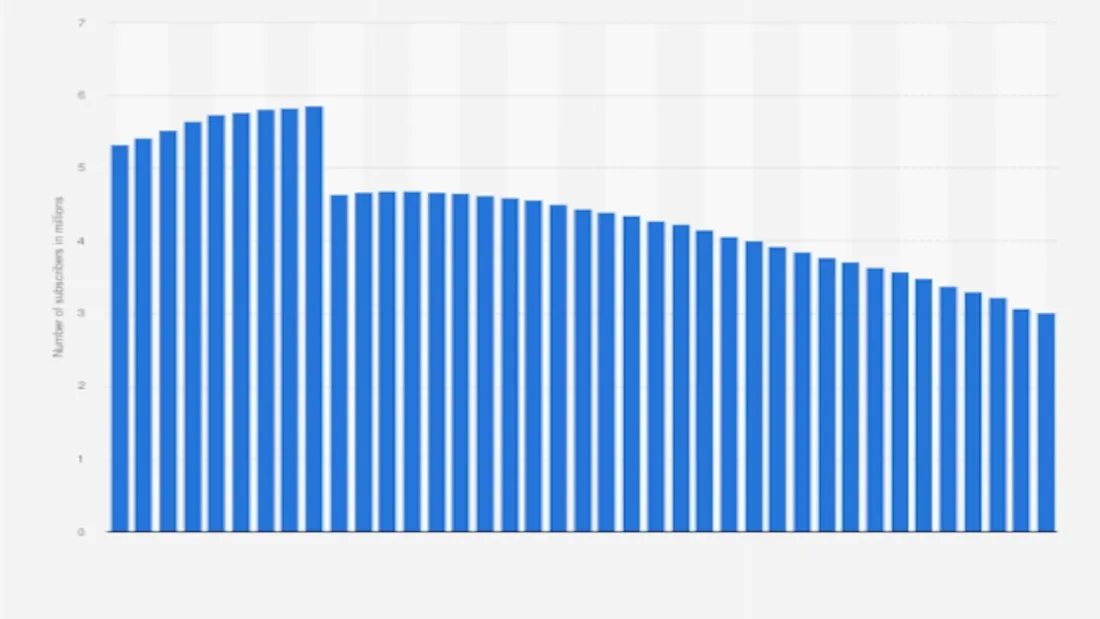

Verizon losing customers has become an alarming trend, with the telecommunications giant reporting a staggering net loss of 289,000 postpaid phone customers during the first quarter of 2025. This exodus matches Verizon's "worst result on record", signaling serious trouble for what was once America's most dominant carrier. Despite having an expansive network across the United States, a network once celebrated for its wireless speed test performance, Verizon is hemorrhaging subscribers at an incredible rate.

Why are so many customers abandoning ship? Recent price increases have certainly contributed to the startling decrease in customers, while many longtime subscribers who have been with the company for decades are now saying their goodbyes and looking for greener pastures. Additionally, Verizon customers are discovering unexpected charges on their bills that they never asked for, further driving dissatisfaction. In fact, both T-Mobile and AT&T now offer plans that customers find more attractive, including internet service options that compete directly with Verizon’s offerings. This troubling pattern raises critical questions about Verizon's business strategies and whether the company can reverse its declining fortunes.

Verizon loses 289,000 customers amid price hikes

Image Source: Statista

Back in early 2017, Verizon lost 289,000 on-contract wireless customers in just six weeks, surprising analysts who had expected the company to add nearly 250,000 subscribers. Fast forward to the first quarter of 2025, and the story has taken an even more troubling turn. Verizon reported losing the same number of postpaid phone customers — 289,000 — in a single quarter, far exceeding Wall Street’s expectations of 166,400 losses and doubling the figure from the same period in 2024. According to New Street Research analysts, this marks Verizon’s worst performance on record.

Verizon CEO Hans Vestberg openly acknowledged that recent price increases were a major factor in this exodus. “We did have a slow start on postpaid phone net adds, largely driven by elevated churn due to recent price ups,” he explained during an April earnings call. Verizon Consumer CEO Sowmyanarayan Sampath echoed the sentiment, admitting the January increases had stronger negative effects than anticipated, noting that “the elasticity on that price up was higher than what we had anticipated.”

Despite the backlash, executives remain committed to their strategy, maintaining that the adjustments were necessary to secure long-term stability for their Verizon plans. Sampath stated, “We made a decision to price up certain cohorts in December and January, and they were the right trade-offs to make.” The company believes these increases effectively locked in revenue for the rest of the year.

Adding to the challenges, Verizon also cited reduced government spending under the new administration as a contributing factor, impacting contracts with FEMA and the Department of Defense. For many subscribers, these developments further fueled dissatisfaction, especially as competitors in the wireless service space continued offering more affordable and flexible alternatives.

Verizon pushes FCC to delay phone unlocking

Amid its ongoing customer exodus, Verizon has petitioned the Federal Communications Commission (FCC) to waive the 60-day phone unlocking requirement currently imposed on the carrier. The company claims this rule costs them “hundreds of millions of dollars annually” from fraudsters who exploit the policy to traffic devices internationally. “Even a lock of 60 days does not deter device fraud – a huge and growing problem in the United States – and instead enables trafficking in devices that are illicitly sent to foreign marketplaces,” Verizon argued in its FCC filing.

Presently, when you purchase a Verizon phone, it remains locked to their network for 60 days before automatically unlocking. Verizon proposes extending this period to match competitors — AT&T locks phones for six months, and T-Mobile enforces its own unlocking policies that often give the carrier an advantage in retaining customers. Verizon argues that its shorter timeframe has become a competitive disadvantage.

However, twelve consumer advocacy groups vigorously oppose the petition, arguing that “fraud is not unique to carriers that unlock after 60 days” and that Verizon provided no evidence a longer lock period would prevent theft. These organizations insist the current policy “promotes consumer welfare, strengthens competition, and reduces regulatory confusion.”

The timing of this regulatory maneuver is particularly noteworthy as Verizon struggles to retain subscribers. Critics suggest this represents yet another obstacle for customers considering switching carriers, essentially trapping them longer on Verizon’s network regardless of service satisfaction.

Regulatory strategy fails to address core issues

Beyond regulatory maneuvers with the FCC, Verizon faces fundamental service issues that continue driving customer departures. The company’s history reveals a troubling pattern of prioritizing regulatory strategies over addressing core customer concerns.

In one infamous case, Verizon throttled Santa Clara County Fire Department’s internet during California’s largest-ever wildfire in 2018, then offered to restore service only if the department upgraded to a more expensive package. Verizon later acknowledged this was a “communication error,” but only after firefighters were hampered during a critical emergency.

Furthermore, Verizon’s technical support repeatedly deflects blame for service problems. Customer complaints document how Verizon representatives attribute poor reception to “device hardware/software, terrain surrounding home, quality of ISP, and house structure” — never suggesting their network might be at fault.

Regulatory records show Verizon only improves service quality after regulatory intervention. California Public Utilities Commission noted that “NRF [New Regulatory Framework] creates incentives to save money at the expense of service quality,” while Delaware regulators found “extremely poor outside plant maintenance conditions.”

Most recently, Verizon abruptly terminated its diversity, equity and inclusion programs at the request of FCC Chairman Brendan Carr to secure approval for its $9.6 billion Frontier Communications acquisition. Moves like this have only made it easier for competitors such as AT&T to win over dissatisfied Verizon customers by positioning themselves as more customer-focused and service-driven alternatives.

Conclusion

Verizon stands at a critical crossroads as it loses customers at record speed. The 289,000 postpaid losses in a single quarter highlight deeper structural problems, with price hikes and service frustrations pushing subscribers toward rivals like T-Mobile and AT&T.”

Regulatory tactics alone won’t stop the churn. While initiatives like offering wireless broadband may help, meaningful improvements in service quality and pricing are essential if Verizon wants to win back customer trust and avoid further erosion of its market share.

FAQs:

A: Verizon is losing customers at a rapid rate due to recent price increases, unexpected charges on bills, and more attractive plans offered by competitors like T-Mobile and AT&T.

A: Verizon reported a net loss of 289,000 postpaid phone customers during the first quarter of 2025, which was described as their 'worst result on record' by analysts.

A: Verizon has petitioned the FCC to extend the phone unlocking period from 60 days to six months, claiming it would help prevent fraud. However, consumer advocacy groups oppose this change.

A: Instead of addressing core service issues, Verizon has focused on regulatory strategies, such as attempting to change unlocking policies and terminating diversity programs to secure regulatory approvals.

A: Many customers are switching to T-Mobile and AT&T, which continue to add new subscribers each quarter by offering more attractive plans and potentially better customer service.