Whether it’s a pebble in your boot on a long hike or a small fee in a retirement savings account, little things that go unnoticed or ignored can lead to an outsized amount of pain.

These seemingly small financial mistakes are worth your full attention:

Letting small fees fester

One-time fees — a $3 out-of-network ATM charge or a $15 service charge for an online ticket purchase — aren’t budget busters. But ongoing fees can be lethal, especially in retirement investment accounts like IRAs and 401(k)s where fees have decades to accrue.

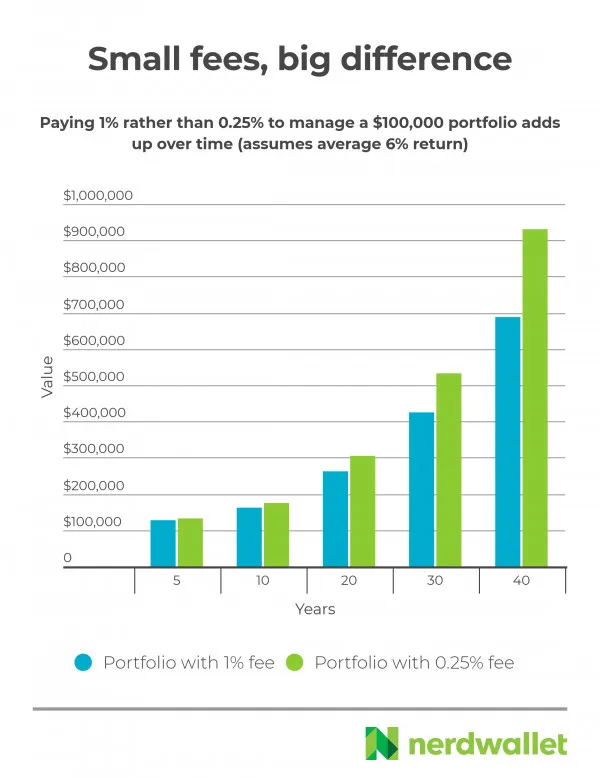

Consider a 1% management fee charged on a retirement savings account. Because the fee is based on the value of the assets in the account, as the portfolio value rises, so does the fee. And, boy, does it compound over time.

Say you have $100,000 in that account and it averages 6% annual returns. After 40 years you’d have $688,085. Great — but you’d have $930,574 if you’d paid only 0.25% in fees.

Paying a bill late

Payment history has a big influence on your credit score. Delinquent payments — 30 days or more past due, or any accounts sent to collections — can cost you much more than a late fee.

The higher your credit score, the better the interest rate you can get on loans. Compare two people shopping for a $250,000 mortgage:

- One has an excellent credit score and gets a 4.375% rate, paying $1,286 a month

- The other has a score in the “good” range, gets a 5.125% rate and pays $1,439 a month

Over the life of the 30-year, fixed-rate mortgage, the person whose credit score is lower would pay $41,000 more in interest.

Thinking about retirement later

The excuses for putting off saving for retirement are plentiful. But the arguments against them are pretty compelling:

I don’t know where to start

If you have a 401(k) or other workplace retirement plan, this is your first stop. If your employer matches a portion of your contribution, invest at least enough to get this free money. No workplace plan? How to Open an IRA in 4 Simple Steps.

I can’t afford investment help

Automation has brought down all the costs of investing, thanks in particular to the rise of robo-advisors. These automated online services help you pick and manage low-fee investments for an affordable fee.

Want a personal touch? Many robo-advisors offer access to humans when you have questions. Or you could hire a fee-only advisor. Here’s how to choose the best type of financial advisor for you.

I can’t afford to start

Many brokerage houses and robo-advisors have no minimum opening balance. Open an account now and add to it whenever you can spare some cash.

I’ll catch up by saving more later

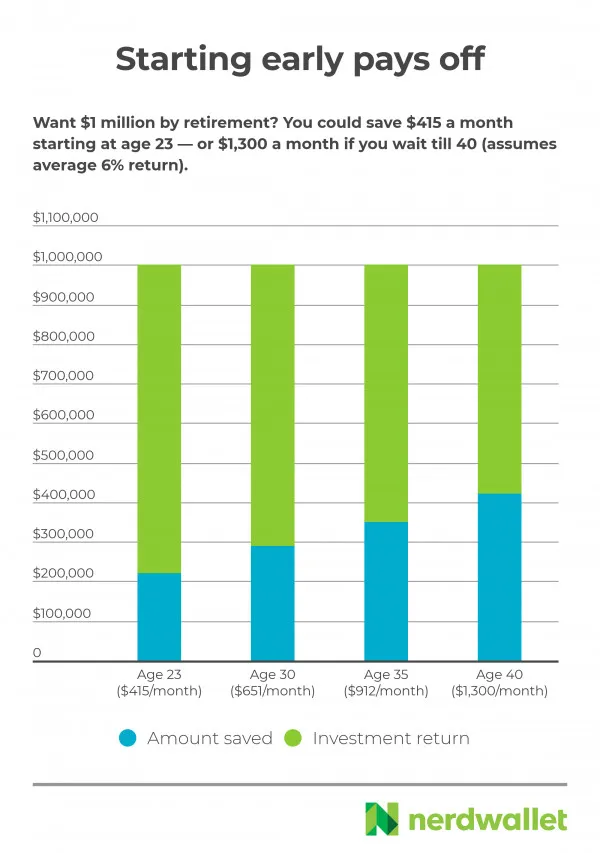

It becomes harder to catch up with each passing year. That’s because compound interest — when earnings on investments grow your balance and generate even more earnings — takes time. If you start at the beginning of your career, saving $415 a month gives you $1 million at 67. Delay until you’re 40 and you’d need to tuck away $1,300 a month to reach that number.

Leaving money in a former employer’s retirement plan

Employer-sponsored retirement plans are great, but once you hand in your resignation letter, a lot of the perks go away:

- No more matching contributions

- Administrative fees, which are sometimes covered by the employer, come out of your account balance

- You don’t have the leverage to push the plan administrator for lower-fee investment options

Public policy group Demos ran the math for a median-income couple, both of whom work. Based on average contribution rates, 401(k) fees and plan costs, over 40 years they’d pay nearly $155,000 in investment fees, giving up almost one-third of their total retirement savings returns.

While you may not be required to take your retirement savings with you when you leave, you probably should.

Moving your 401(k) money into an IRA (see the IRA “rollover” process outlined here) eliminates those administrative fees. It also opens up the universe of investment options, letting you shop around for funds with the lowest management fees. Plus you can retain the same tax benefits the workplace retirement plan offered.

More From NerdWallet

- What a Fed Rate Hike Means for Borrowers, Savers and Home Buyers

- Fetch Gear Deals and Get Your Dog’s Tail A-Wagging

Dayana Yochim is a writer at NerdWallet. Email: dyochim@nerdwallet.com. Twitter: @DayanaYochim.

The article Small Financial Mistakes That Could Cost You Big originally appeared on NerdWallet.