“If one advances confidently in the direction of his dreams, and endeavors to live the life that he has imagined, he will meet with a success unexpected in common hours.” Henry David Thoreau

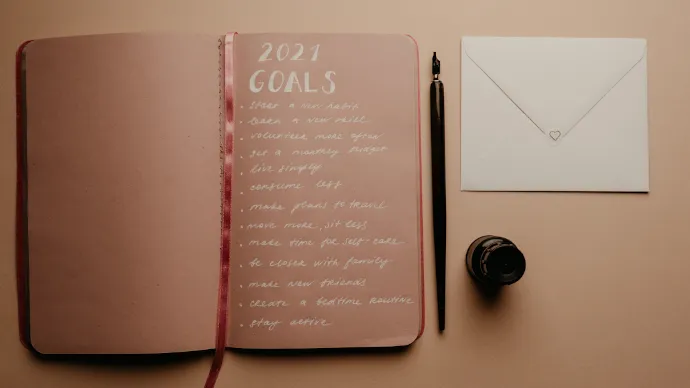

Whew! We made it through a terrible year, and really are looking forward to 2021. Traditionally, this is the time to make resolutions to improve our lives, so BILLSHARK would like to offer some for the financial area of your life.

It’s important not only to make financial resolutions, but to be able to stick with them, as well. That’s why they should be realistic and—most important—help move you toward your financial goals.

1. Start where you are

Because it’s the end of the year, you’ll be getting twelve-month credit card summaries and annual bank statements. So use these to review how you’ve handled your money in the past year.

Don’t beat yourself up, but do take a clear-eyed look at how many of your purchases were necessary and how many were impulse purchases that didn’t spark joy once you got them home.

2. Look at where you want to go

It’s much easier to save and forgo momentary pleasures if you have a reason for doing so. That’s why you need to ponder what you really want out of life, both in the near future and long term.

- Do you want a better-paying job? Or a more rewarding one?

- Do you want to get married? Have kids? How many?

- Do you want to own a home? Where?

- Do you want more time and/or money to pursue a favorite hobby?

- Do you want to retire early?

- Do you have a vision for how to contribute to society? The planet?

There’s an old saying: If you don’t know where you’re going, any road will get you there. If you do have a vision, you need to lay out a roadmap for achieving it.

3. It’s all about the budget

“Budget” is not a four-letter word: It’s a blueprint for getting you from where you are now to where you want to go. Call it a “spending plan,” if that makes it feel less restrictive. Either way, take a hard look at your income vs. your expenses.

You need money for basics:- food

- shelter

- clothing

- transportation

You also need a little extra to feed your soul, whether that’s a daily latte, money for birdseed, books, a streaming service, or an occasional night out with friends (once the pandemic’s under control). Whatever it is that brings a little happiness into your life, include it in your plan. Otherwise, you’ll feel deprived, no matter what exciting goals you’re saving for.

4. The smart moves

Once you have the basics covered, it’s time to start paying attention to the experts who make the rules about what to do with your money.

These include, in order:- create an emergency fund

- pay down debt, especially credit cards

- invest in retirement savings

As we’ve seen with the pandemic, an emergency fund is crucial. Most financial gurus advise setting aside at least six months worth of living expenses. It’s difficult for the average American to manage that, though.

But having an extra $5 or $10 bucks automatically diverted into a savings account every month can quickly add up. And it can mean the difference between survival and disaster in case of a job loss, illness, or unexpected car repair bill. It can also help you sleep a little better at night.

If you don’t have enough money to do any of these things, start making a plan to increase your income. Can you get a side hustle going? Take classes or obtain certifications to get a raise or a better job?

Sticking with the plan

Studies show that the vast majority of New Year’s resolutions are a distant memory by February. That’s why it’s important to create a financial resolutions that are:

- reasonable (for your particular situation)

- specific

- measurable

- achievable

- freeing

By “freeing,” we mean goals that help move you out of “just coasting” and toward the life of your dreams.

The industrialist Andrew Carnegie said it best:“If you want to be happy, set a goal that commands your thoughts, liberates your energy, and inspires your hopes.”

In the late 19th Century, he became one of the richest men in America, as well as a leading philanthropist, donating the equivalent of $5 billion to charities, foundations, and universities by the time he died at age 83.

What do you want to do with your life? Start planning today!

And if you’re looking to find some extra cash, look to BILLSHARK. We have helped thousands of Americans save hundreds or even thousands of dollars on their bills. And we charge nothing unless we can save you money.